Investing in financial assets is a common way for individuals to diversify their investment portfolios and make more informed decisions about how to best use their money. There are many different types of financial assets available, each with its own set of advantages and disadvantages.

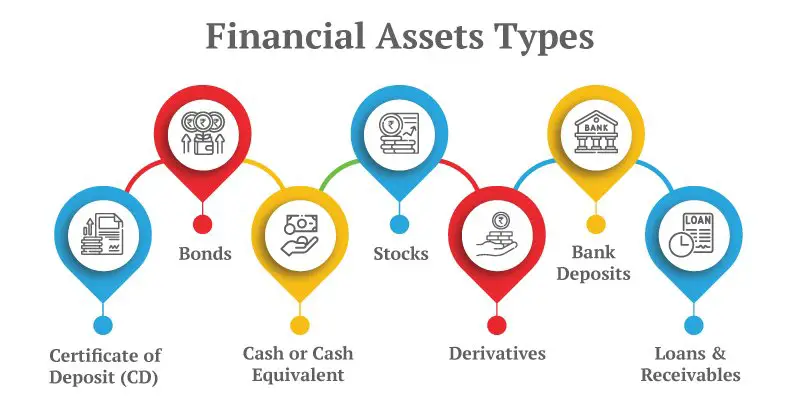

This article will explore the different types of financial assets such as:

- Stocks

- Bonds

- Mutual funds

- Options

- Real estate investment trusts (REITs)

- Cryptocurrencies

- Annuities

- Insurance products

- Investment accounts

It will discuss their respective characteristics and the ways in which they can be used to construct an optimal portfolio.

READ ALSO: Understanding Financial Markets

Types Of Financial Assets

#1. Stocks

An investment in stocks can provide investors with the potential for capital appreciation and dividend income. Typically, stocks are issued by a company or business that represents ownership of the company's assets and profits.

Investors that purchase stocks become shareholders of the corporation and have partial ownership in the company, allowing them to benefit from dividends payments as well as any increase in stock prices.

However, stock market volatility may cause stock prices to fluctuate significantly, meaning there is no guarantee of return on investment.

When investing in stocks, it is important to understand the various types of stocks available such as growth stocks or value stocks. Growth stocks typically perform better than average when markets are doing well but may be more volatile during downturns; while value stocks tend to perform better during economic recessions but may not grow as quickly during times of expansion.

Knowing which type of stock suits an investor's goals and risk tolerance can help them make informed decisions when choosing which securities to invest in.

It is also important for investors to be aware of their tax implications when investing in equities since capital gains taxes apply when selling a security at a higher price than what was paid for it originally. Understanding these key concepts can help investors maximize returns on their investments while mitigating risks associated with trading in the stock market.

#2. Bonds

Bonds are a type of financial asset that involve loan agreements between an issuer and a lender.

U.S. Treasury Bonds, Corporate Bonds, Municipal Bonds, and Junk Bonds are all common types of bonds that can be purchased by investors.

U.S. Treasury Bonds are backed by the full faith and credit of the United States government; Corporate Bonds are issued by corporations to raise money for various operational costs.

Municipal Bonds provide funds for public works projects such as schools, roads, or hospitals in municipalities; and Junk Bonds represent bonds with below-investment-grade ratings that carry higher risk but also offer higher yields than other bonds.

U.S. Treasury Bonds

U.S. Treasury Bonds are a valuable security issued by the United States Government, offering investors a reliable source of income and protection against inflation. These bonds are typically sold in auctions scheduled on certain dates throughout the year, with the prices determined by competitive bidding among investors at each auction.

The yields on U.S. Treasury Bonds can also be used to create yield curves for use in various financial calculations, such as forecasting future interest rates or pricing other types of bonds. Overall, U.S. Treasury Bonds provide stability and reliable returns to investors looking for long-term investments that offer protection from inflation while providing steady income over time.

The nature of U.S Treasury Bonds makes them distinct from corporate bonds, which represent debt obligations of corporations rather than governments or government agencies and carry different levels of risk depending on the issuer's creditworthiness and other factors related to its business operations and prospects for future success.

As such, corporate bonds require greater analysis before investing than do Treasuries due to their higher levels of risk but generally provide a higher return rate for those willing to take on the additional risks associated with investing in corporate debt securities –in particular, the risk of potential default.

Corporate Bonds

Investing in corporate bonds can provide investors with an opportunity to earn higher returns than those offered by U.S Treasury Bonds, but with greater levels of risk associated with the issuer's creditworthiness and other factors related to its business operations.

Corporate bond ratings are one of the primary considerations for investors when assessing the risk associated with these investments. Ratings may range from AAA (highest) through BBB (lowest), and help indicate the likelihood that a company will be able to meet their bond obligations.

The yield curve is also used to evaluate potential returns; this curve compares the interest rate paid on various maturity dates for a particular type of bond, allowing investors to compare expected returns over time.

With an understanding of both corporate bond ratings and yield curves, investors can make more informed decisions about investing in corporate bonds while considering potential risks associated with default or other issues.

With those risks in mind, municipal bonds may offer another option for fixed-income investing.

Municipal Bonds

Municipal bonds provide investors with an option for fixed-income investing, offering the potential to ‘get a bird in the hand' while avoiding some of the risks associated with corporate bonds.

Municipal bonds are debt obligations issued by states, cities, counties, and other governmental entities to finance public projects such as bridges, schools, and sewers. They typically offer higher yields than comparable Treasury securities due to their tax-exempt status on municipal taxes.

Bond ratings can be used to determine the creditworthiness of municipal bond issuers; investment grade ratings indicate lower-risk investments.

Investing in municipal bonds can offer many benefits compared to corporate bonds: they may have higher yields due to their tax-exempt status; they tend to have less volatility than corporate bonds; and they may be more secure since they are backed by governments or government agencies rather than individual corporations.

Furthermore, unlike junk bonds which carry high levels of risk, municipal bonds generally have lower default rates since they are backed by federal or state governments. This makes them an attractive alternative for those seeking a safe and relatively low-risk investment vehicle.

Junk Bonds

Junk bonds are high-risk debt securities that offer higher yields than investment-grade bonds. Such bonds come with a speculative nature, as they typically have lower ratings and higher default risk than other types of bonds.

Investors who want to pursue high-yield investing may consider junk bonds, as the high-yield potential could be appealing despite the increased risk. However, investors should consider their overall financial goals and risk tolerance before investing in such assets.

Additionally, it is important to diversify investments across different asset classes for optimal returns. With this in mind, mutual funds provide an attractive option for those looking for diversification across a range of assets while also gaining exposure to the stock market.

#3. Mutual Funds

Mutual Funds offer a wide range of investment opportunities to diversify portfolios and manage risk. Investing in mutual funds can provide an investor with access to a variety of different assets including stocks, bonds, commodities, money market instruments, and real estate.

Mutual funds are managed by professional fund managers who use their expertise to select and manage a portfolio of assets that match the objectives established for the fund.

Additionally, mutual funds can have tax advantages as taxes on capital gains are deferred until the fund is sold or exchanged. Mutual funds may also offer lower costs than similar investments because they involve economies of scale due to pooling investors' money together.

This allows for smaller investors to benefit from larger transactions and diversification that would be too costly if they attempted it on their own.

Fees associated with investing in mutual funds are typically lower than those associated with other forms of investing such as individual stocks or bonds which could lead to higher returns over time for investors.

The key consideration when investing in mutual funds is whether it meets one's personal investment goals and whether the return generated will exceed any additional risks taken on by investing in this type of asset class.

By considering these factors carefully before selecting a mutual fund, an investor will be more likely to achieve their desired returns while managing risk effectively. With this knowledge, we can move on to exploring options as another type of financial asset available for portfolio diversification and risk management purposes.

READ ALSO: Understanding Financial Statements

#4. Options

Options are a type of derivative that gives the owner the right to buy or sell an asset at a predetermined price.

Call options give the owner the right to purchase an asset before its expiration date, while put options give the holder the right to sell an asset before its expiration date.

These features make options unique as they allow traders to gain exposure and leverage in markets without having direct ownership of assets.

Call Options

A Call Option is a contract that gives the holder the right to purchase an underlying asset at a predetermined price within a specified timeframe. This type of financial instrument provides investors with opportunities to hedge against market volatility, as well as benefit from potential gains in exchange-traded funds or other assets.

It also enables investors to leverage their positions by purchasing call options at a lower cost than the amount they would need to invest in order to gain exposure to the same level of risk in the underlying asset.

Moreover, many investors use call options as part of hedging strategies, such as straddles and collars, which involve buying both calls and put options for a specific security or index.

By combining these two types of options, an investor can potentially reduce their losses while still maintaining some upside potential if prices move favorably.

Put options are another type of financial instrument that provide similar benefits but differ in terms of how they are structured and exercised. Put options offer holders the opportunity to sell an underlying asset at a predetermined price within a specific period of time.

While this may seem like it would be more beneficial than call options during bear markets, there are often associated costs involved that may limit overall profits when compared with call option strategies.

Put Options

Put options offer the holder the ability to sell an underlying asset at a predetermined price within a certain time frame. This type of financial asset is advantageous for investors who believe that the market will move in a downward direction and they want to benefit from selling high before prices drop.

An option spread, which involves both put and call options, can be used as well to create different strategies. One strategy would be to buy one put option and simultaneously sell another with a higher strike price but the same expiration date; this decreases risk while still allowing potential profit.

The value of the option also includes intrinsic value and time value components, making it important for investors to consider the current market conditions when trading these types of assets. In addition, investors must understand how changes in volatility affect option prices over time.

Overall, understanding put options is essential for any investor wanting exposure to bear markets or looking to hedge their existing investments. As such, transitioning into real estate investment trusts (REITs) provides another layer of diversification in portfolio management by investing in physical real estate properties instead of stocks or bonds.

#5. Real Estate Investment Trusts (REITs)

Real Estate Investment Trusts (REITs) offer investors a unique opportunity to invest in real estate. They allow individuals to invest in portfolios of professionally managed real estate funds without having to buy and manage properties directly.

REITs are designed for investors who want the potential returns that come with direct ownership of real estate but don't necessarily have the resources or desire to be active landlords.

They offer diversification, liquidity, tax advantages, and professional management. REITs are typically structured as public companies traded on stock exchanges or as private funds which may require large initial investments.

Publicly listed REITs are required by law to distribute at least 90% of their income from rental income and interest payments on mortgages back to shareholders each year, making them attractive investments due to their high rate of return potential.

Private REITs generally have higher risk levels than publicly-listed ones but can provide larger returns when successful investments are made.

Unlike other financial assets such as stocks and bonds, investing in REITs provides access to a different asset class: physical real estate property.

Investing in REITs allows an investor the benefit of diversifying their portfolio into a potentially lucrative asset class while avoiding significant overhead costs associated with direct ownership of property such as maintenance fees and tenant acquisition costs.

With these factors considered, it is easy to see why Real Estate Investment Trusts offer an attractive option for many investors looking for exposure in the real estate market without taking on too much risk or responsibility.

#6. Commodities

Commodities are products or raw materials that are traded in the global market, such as gold, silver, crude oil, and grains. They are bought and sold through commodity exchanges across the world, with futures trading being a primary means for purchasing commodities.

Futures trading is an agreement to buy or sell a specified quantity of a commodity at a predetermined price on a specific future date. It allows investors to hedge their positions against potential losses by buying or selling contracts in order to offset their existing investments.

This type of investment gives traders the opportunity to speculate on the future prices of commodities while avoiding any physical delivery of the assets themselves.

Commodity exchanges allow buyers and sellers to come together in one place for buying and selling goods, providing liquidity, transparency, and security for trading activities. Most exchanges provide clearing services as well as reports that track price movements over time so that traders can make informed decisions about their investments.

Commodities can be used both as short-term trades taken based on current market conditions or long-term investments depending upon individual investor needs and objectives.

However, it should be noted that commodity prices may be more volatile than other types of financial assets due to supply/demand imbalances which could result in significant gains or losses depending on market conditions at any given time.

Investing in commodities can be risky but also potentially rewarding if done correctly with proper research into the economic fundamentals behind each asset class being purchased.

With this knowledge, investors can take advantage of extreme price swings by either taking profits when prices increase or hedging against losses when they decrease during periods of high volatility thus giving them better control over their portfolio performance overall.

#7. Cryptocurrencies

Cryptocurrencies are digital or virtual currencies that use cryptography to secure and verify transactions, as well as control the creation of new units. Cryptocurrencies differ from traditional forms of money in several ways:

1) They do not rely on a central bank or other third-party institution for issuing currency; instead, they are generated by a complex mining process that involves computers solving mathematical equations.

2) They offer an unprecedented degree of anonymity since users do not need to provide their personal information when making payments.

3) Transactions with cryptocurrencies are almost instantaneous, compared to traditional payment methods which can take days to clear.

4) While cryptocurrency transactions are generally secure, wallet security is key in protecting against malicious actors who could steal your funds if your wallet is compromised.

Unlike stocks and bonds, cryptocurrencies have no underlying real value and their prices can be highly volatile. Additionally, unlike commodities such as gold and oil which have tangible uses, the only use for most cryptocurrencies is trading them in hopes of making a profit.

As such, investing in cryptocurrencies should be approached with caution and requires careful research into factors such as market sentiment and technical analysis. Despite these risks, many investors have seen significant returns on their investments due to the high volatility of cryptocurrency markets.

Cryptocurrency markets present both opportunities and challenges for traders and investors alike. Those looking to get involved must understand the risks associated with this asset class while also being aware of the potential rewards that may come with it.

With proper education and research about the nuances of cryptocurrency markets, one can become informed enough to make informed decisions about how best to proceed in this dynamic space.

From there it will be up to individual traders or investors whether they choose to pursue profits through crypto assets or look elsewhere for other investment opportunities like annuities.

#8. Annuities

Annuities offer a unique opportunity for investors to diversify their portfolios with low-risk, long-term investments that can yield substantial rewards over time.

They are contracts between an investor and an insurance company, in which the investor agrees to pay a lump sum or periodic payments and receive back guaranteed payments from the insurance company at predetermined intervals.

Annuities can be used as a form of taxation strategy for estate planning purposes and retirement income planning. Annuity holders typically benefit from tax deferment on their earnings; they only pay taxes once income is received.

In addition to providing steady returns over time, annuities also provide death benefits that guarantee payment of any remaining principal and accrued interest to designated beneficiaries in the event of the annuity holder's death before maturity.

Additionally, annuities are typically inflation-adjusted, allowing them to maintain their purchasing power over time. They also tend to have lower fees than other financial assets such as stocks or bonds.

Due to these advantages, annuities have become increasingly popular among investors seeking low-risk strategies for long-term wealth accumulation and security.

While there are some drawbacks associated with investing in annuities—including surrender charges if an investor wants out early—they still remain one of the most appealing options for many investors looking for consistent returns across different types of financial assets.

#9. Insurance

Insurance is a form of risk management in which the insured transfers the cost of potential losses to an insurance company.

Insurance policies are divided into three distinct categories: life, health, property, and casualty.

Life insurance covers death or other specified events; health insurance provides coverage for medical expenses; and property and casualty insurance protects against losses resulting from damage to personal or business property.

Life Insurance

Life insurance provides a sense of security and financial protection to individuals and their families. It is an agreement between the policyholder and insurer, where the policyholder pays premiums for a predetermined period of time in exchange for risk coverage.

The main purpose of life insurance is to provide financial security to dependents in case the policyholder passes away. Here are some key points on life insurance:

- Premiums: Payments made by the policyholder to keep the policy active.

- Risk Coverage: The amount that will be paid out in case of death or disability, as stated in the contract between the insurer and the insured individual.

- Tax Benefits: Life insurance may come with tax benefits depending on your country's laws.

- Investment Opportunities: Life insurance can also provide investment opportunities through annuities or other policies-related investments such as stocks, bonds, etc., which can help generate income over time.

By providing financial protection against unexpected losses due to premature death, life insurance helps ensure that individuals and their loved ones are taken care of financially even after they are gone. This makes it an essential part of any sound financial plan.

Health Insurance

Life insurance is a type of financial asset that provides protection against financial consequences in the event of a person's death. While life insurance is intended to provide benefits to the policyholder's beneficiaries after death, health insurance offers financial protection for medical expenses incurred during a person's lifetime.

Health insurance costs and premiums can vary greatly depending on the provider, type of coverage, and other factors. It is important to compare different options when selecting the best health insurance plan.

Premiums for health care policies are typically higher than those associated with life insurance plans due to the greater risk associated with providing short-term coverage versus long-term security.

Additionally, certain types of health care plans may include additional features such as prescription drug coverage or preventative services which can further increase costs.

By understanding these differences and researching various providers, individuals can find a plan that fits their needs while providing adequate coverage at an affordable price.

As such, it is important to weigh all options before making any decisions about health care policies. This same approach should be taken into consideration when looking into property and casualty insurance as well.

Property and Casualty Insurance

Property and casualty insurance provides financial protection against a variety of risks, including those associated with property damage, liability, and other losses. Risk management is an important part of these policies as it helps to reduce the chances of large claims being brought against the insured.

The process can include risk assessment, loss prevention strategies, and selecting appropriate coverage limits for each policyholder. Claims adjusting is also important when it comes to property and casualty insurance because this process ensures that all claims are properly handled and all parties involved in a claim receive adequate compensation.

Additionally, property and casualty insurance can be beneficial for businesses due to its ability to protect them from potential losses caused by events such as natural disasters or lawsuits.

This type of financial protection allows businesses to continue operations despite unexpected events or circumstances. These types of insurance policies are essential for any business owner who wishes to limit their exposure to risk.

With this in mind, investment accounts may provide further protection against unforeseen risks by allowing individuals and businesses alike to diversify their portfolios with different asset classes and strategies.

#10. Investment Accounts

Investment accounts are a way to save and grow money for the future.

There are multiple types of investment accounts including savings accounts, Individual Retirement Accounts (IRAs), and 529 College Savings Plans.

Each type of account offers different tax benefits and features that should be considered when thinking about investing in the future.

Savings Account

A savings account is a popular way to store and protect funds. It is typically recommended for individuals who are looking for a low-risk investment option that allows them to easily access their money when needed.

Savings accounts offer many advantages, including high-interest rates, tax benefits, and the ability to deposit or withdraw funds at any time. This makes it an attractive choice for those who want to set aside money for short-term needs without taking on too much risk.

Although savings accounts may not provide the same returns as other types of investments, they can be an effective way to save and grow wealth over time.

Savings accounts also have some drawbacks that should be considered before investing in one. For example, most savings accounts have limited withdrawal limits and require minimum deposits each month in order to maintain the account's balance above a certain threshold.

In addition, the interest rate offered by many banks may not keep up with inflation which can result in lower returns than expected over time.

Despite these potential issues, savings accounts remain a safe and reliable way to store funds while still earning some interest income on your money.

With this in mind, transitioning into individual retirement accounts (IRAs) can be beneficial as it provides additional tax benefits while allowing you to continue growing your wealth over the long term.

Individual Retirement Accounts (IRAs)

Individual Retirement Accounts (IRAs) are a common type of investment for retirement savings. They offer tax optimization benefits, as the funds deposited into an IRA may be eligible for certain deductions on taxes. Additionally, IRAs provide more flexibility than other retirement accounts when it comes to asset allocation.

For example, investors have the option to choose from individual stocks and bonds or mutual funds within their IRA account. This allows individuals to tailor their portfolios according to their risk tolerance and investing goals.

IRAs can also offer higher returns than traditional savings accounts because they allow individuals to invest in securities that they might not otherwise be able to access due to required minimum investments or fees associated with other investments.

As such, IRAs are an effective tool for creating a diversified portfolio that is tailored to one's individual needs and preferences. When used properly, IRAs can maximize returns while minimizing risk over time as part of a comprehensive retirement plan.

With this knowledge in mind, we now turn our attention toward college savings plans which allow parents and students alike to save money for future educational expenses.

529 College Savings Plans

College savings plans to provide an opportunity for parents and students to plan ahead for educational expenses, with the adage that a penny saved is a penny earned' in mind.

Two popular college savings plans are 529 Plans and Coverdell Education Savings Accounts (ESAs).

529 Plans are state-sponsored programs that allow individuals to save money on a tax-advantaged basis for qualified higher education expenses. Contributions to 529 Plans can be made by any person at any time, but the account owner—typically, the parent or guardian—retains full control over how funds are allocated.

Alternatively, Coverdell ESAs also offer tax advantages when saving money for education. However, contributions are limited to $2,000 per beneficiary each year and must be used before their 30th birthday (or rolled into another ESA), or else taxes will be owed on withdrawals.

Both of these college savings plans offer different ways to help families prepare financially for future higher education expenses without sacrificing current financial stability.

READ ALSO: Learning How To Trade With Forex Demo Account

Frequently Asked Questions

What is the best way to diversify my portfolio with these financial assets?

Diversifying a portfolio is an important strategy to increase returns while reducing risk. Risk return analysis provides a useful tool in determining the best way to diversify as it looks at both the expected returns and risk associated with various financial assets.

When building a diversified portfolio, investors should consider their overall objectives, such as long-term growth or income generation, and then use these goals to develop an appropriate diversification strategy.

Popular strategies include:

– Global diversification which spreads investments across countries or geographic regions

– Sector allocation which distributes investments among industries

– Asset class allocation which divides investments between stocks, bonds and other types of securities

– Individual security selection where investors select specific stocks or bonds based on their own analyses.

By utilizing one or more of these strategies when constructing a portfolio, investors can create an optimal balance between risk and return that is tailored to their own needs.

What are the tax implications of investing in each type of financial asset?

Investing in financial assets can be a great way to save for retirement or generate extra income, but an often overlooked element is the tax implications associated with each type of asset.

While stocks and bonds generally have the same tax treatment, options and other forms of derivatives may offer investors a more tax advantaged investing strategy.

Cost saving strategies like these can help investors keep more of their profits while still achieving their investment goals. However, even with these benefits, it's important to understand the specific taxes associated with each type of asset before making any investment decisions.

What are the risks associated with investing in each type of financial asset?

Investing in financial assets can be a rewarding experience, as it provides the opportunity for investors to earn returns on their investments. However, there are also associated risks that must be taken into account when making an investment decision.

Depending on the asset type chosen, risk levels can vary greatly and understanding these potential risks is crucial prior to making any investment decisions.

Stocks and options often have higher levels of risk than bonds and other fixed-income securities due to their potential for greater return; however, they also carry increased uncertainty of returning profits versus more conservative investments.

Thus, potential investors should consider not only the return but also the level of risk associated with each type of financial asset before investing in order to make an informed decision about which asset will best meet their needs.

What are the best strategies for investing in each type of financial asset?

When it comes to investing in financial assets, it is important to consider the best strategies for each type of asset. Choosing the right broker and diversifying strategies are two key elements in any successful investment plan.

It is essential to select a broker who has experience managing different types of investments and can provide sound advice on which asset classes may be most suitable for an individual investor's situation.

Additionally, diversifying strategies across different asset classes can help reduce risk by spreading out returns over multiple sectors.

Ultimately, understanding the available options and developing a strategic plan that takes into consideration both short-term gains as well as long-term goals is essential for any successful investment strategy.

How can I choose the right financial asset for my needs?

When choosing the right financial asset for one's needs, it is important to consider both buying strategies as well as investment timing.

Determining an appropriate amount of risk is essential in selecting a suitable asset, as different levels of risk will correspond with different types of assets.

It is also beneficial to research individual investments in order to gain insight into their historical performance and potential future trends.

Additionally, investors should be aware of their personal goals and how an asset may help or hinder progress towards those objectives.

All these considerations are vital when seeking to make informed decisions that can lead to successful long-term investing.

Conclusion

In conclusion, it is evident that there are several different types of financial assets that can be utilized to build and maintain a strong portfolio.

From stocks and bonds to mutual funds and REITs, investors have an array of options with which to diversify their investments.

Cryptocurrencies and annuities also offer unique opportunities for those looking to take advantage of the ever-changing financial landscape.

Additionally, insurance products and investment accounts provide essential protection against market volatility.

With careful consideration of the risks associated with each asset type, investors can create a balanced portfolio tailored to their individual needs and goals.

I believe this article was helpful to you and that you enjoyed every bit of it. Please feel free to leave us a comment below if you have any. Also, help us share this article on social media to help us reach more people who needs this information. Thanks!!! Follow Us on Socials: LinkedIn - Facebook - Twitter

Discover more from iParrot Wealth

Subscribe to get the latest posts sent to your email.