Let's talk about Apple Financial Performance and Stock Market Trends. Apple Inc. has experienced unprecedented success in the past decade, becoming one of the world's most valuable companies and transforming itself into a global household name.

As Apple continues to establish itself as an industry leader, it is important to examine its financial performance over time and assess how stock market trends have affected the company's share prices.

This article will evaluate Apple's financial performance since 2010 by exploring key indicators such as total revenue, operating profits, net income, return on equity (ROE), and dividend payouts.

Additionally, the article will discuss historical stock price movements and analyze any potential correlations between these factors with regard to their influence on Apple's current share value.

By examining this data from both a quantitative and qualitative perspective, this article seeks to provide readers with greater insight into Apple's long-term earnings power within the context of broader economic conditions.

READ ALSO: Apple's Corporate Social Responsibility Initiatives

- Overview Of Apple Inc.

- Total Revenue Analysis

- Operating Profits Analysis

- Apple's Net Income Analysis

- Return On Equity Analysis

- Dividend Payouts Analysis

- Historical Stock Price Movements

- Correlation Between Factors And Share Value

- Frequently Asked Questions About Apple Financial Performance and Stock Market Trends

- Conclusion

Overview Of Apple Inc.

Apple Inc. is a multinational technology company that designs, manufactures, and markets consumer electronics, computer software, and online services.

The brand recognition of Apple has become one of the most recognizable in the world due to its innovative product designs and user-friendly features. This wide global presence has resulted in an increase in customer loyalty amongst its consumers who are passionate about its products and services.

As a Fortune 500 company with a market capitalization of over $1 trillion dollars as of 2020, Apple's financial performance continues to be strong despite global economic uncertainties.

Over the past five years, earnings per share have grown at an average annual rate of 15%, while revenue rose by 11%. It also boasts one of the highest net profit margins when compared to other tech companies such as Microsoft Corporation and Amazon Inc.

The stock price for Apple has been steadily rising since 2013 with only minor downtrends during periods of macroeconomic volatility or market corrections.

As it stands today, AAPL shares are trading near all-time highs due to high investor confidence in the future growth prospects of the company. With this momentum continuing into 2021, there appears to be no sign that this trend will slow down anytime soon.

Total Revenue Analysis

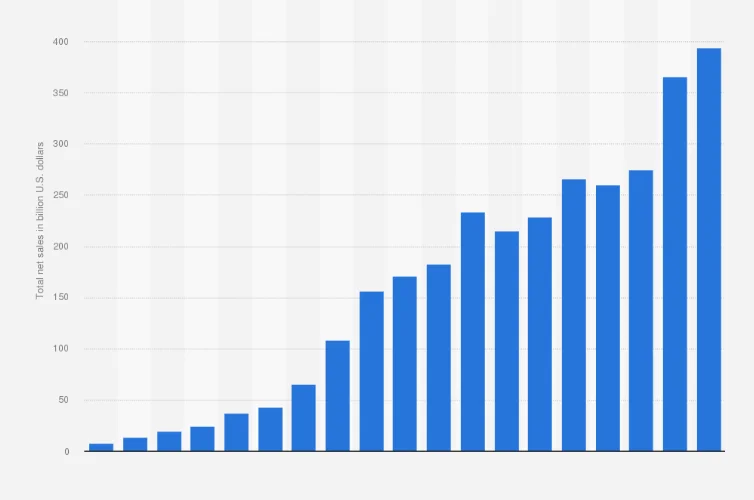

Apple Inc. has seen a steady increase in total revenue year-over-year since 2014.

The company's total revenue in 2020 was at an all-time high, exceeding $274 billion.

When compared to other global corporations, Apple has consistently ranked among the top five companies by total revenue over the past two years.

Additionally, the stock market trends of Apple Inc. have reflected the company's strong financial performance, with the stock price increasing by more than 50% since the beginning of 2020.

Apple's Total Revenue Over Time

Apple Inc. has been a leader in the technology industry for decades, and this is evident through its total revenue over time.

Since 2000, Apple's total revenue has increased exponentially despite fluctuations due to product cycles and competitive pressures.

The company's branding power and ability to introduce innovative products have enabled it to remain profitable even when other firms may experience financial hardship.

In addition, their expansive distribution network across the globe allows them to capitalize on emerging markets and new customer segments.

As of 2019, Apple had achieved an annual net income of $55 billion dollars as compared to just $6 billion in 2000 – representing a nearly 900% increase from two decades prior.

This demonstrates that Apple is well-positioned for continued success as long as they continue leveraging their brand recognition and developing high-quality products at reasonable prices.

Global Total Revenue Comparison

In order to further analyze Apple Inc.'s total revenue, a comparison of the company's global sales figures across different countries and regions can be conducted.

This comparison allows for an understanding of how much Apple is able to capitalize on different markets, as well as any potential areas that may require more focus from their supply chain management team.

Currency volatility must also be taken into account when evaluating these numbers since fluctuations in exchange rates could have a significant impact on overall profits.

Furthermore, it is necessary to consider whether or not the products are reaching consumers at competitive prices due to varying labor costs between nations.

With this analysis complete, investors and analysts will gain insight into where Apple should deploy resources in order to maximize returns while maintaining healthy margins.

READ ALSO: Apple's Patent and Intellectual Property Strategy

Operating Profits Analysis

Apple Inc.'s operating profits can be likened to a river, with cash flows forming the source and cost structure determining its current depth.

Cash flow acts as an integral foundation for Apple's success; it is evident in the company's revenue growth over the last few years which has been driven by strong sales of products like iPhones and iPads.

Meanwhile, Apple's cost structure has grown at a slower rate than its revenues, resulting in higher gross margin percentages and increased net income year-over-year.

The composition of Apple's costs provides further insight into how the company operates efficiently while managing expenses effectively. Cost of sales consists mostly of direct product costs associated with hardware components used in these products such as processors, memory chipsets, and other related materials.

Additionally, research & development expenses have remained consistent despite increasing levels of competition in the tech industry space – this speaks to the extent of innovation delivered by Apple on a continuous basis.

Understanding the dynamics between cash flow and cost structure helps provide more clarity around Apple's overall financial performance given that both are highly interrelated aspects when analyzing companies from a financial perspective.

The next step then is to dive deeper into their generated net income to assess whether there is indeed good news for investors or not.

Apple's Net Income Analysis

Net Income Analysis is the process of examining a company's financial performance over time by evaluating the net income generated from revenue, costs, and expenses.

Apple's Profitability is measured through metrics such as net income, return on equity, and net margin.

Apple's Earnings are reflected in the company's financial statements, which provide insight into how the company is performing relative to the market.

Analyzing Apple's financial performance is important for investors to understand the company's current financial position and determine if it is a viable investment option.

Net Income Analysis

Apple Inc.'s net income has been steadily increasing over the past few years.

In fiscal 2019, Apple reported a record-breaking $55 billion in net income with total revenues of approximately $260 billion for that same period.

This revenue number was up 9% from 2018 and is seen as an indication of the company's strong financial performance and potential growth opportunities going forward.

A further consideration to highlight within this analysis is how cash flow impacts company valuation, as it directly affects share prices on the stock market—and this may be especially pertinent given Apple's recent decisions regarding dividend payments and other capital returns.

It should also be noted that Apple has made substantial investments into research & development (R&D) activities during its latest fiscal year, which could lead to improved products and services down the line; ultimately leading to increased profitability in future periods.

As such, investors must weigh both long-term considerations like R&D spending while keeping an eye on short-term indicators like quarterly earnings reports when considering whether or not to invest in any particular company.

Apple's Profitability

When analyzing Apple's profitability, it is important to consider its cost structure and pricing strategy alongside its reported net income figures.

Cost structure refers to the number of expenses that a company incurs in order to produce goods or services for sale; this includes both variable costs (which vary with changes in production levels) and fixed costs (those that remain constant regardless of output).

Pricing strategies refer to how a company sets prices on its products or services, which needs to be balanced between allowing them to make a profit while still being competitively priced relative to other offerings in the market.

By understanding Apple's cost structure and pricing strategy, investors can gain insight into how efficiently they manage these elements and whether they are likely to generate profits going forward.

Additionally, when evaluating Apple's financial performance it is also important to look at its cash flow statement as this provides further information regarding its ability to generate money through operations rather than relying solely on investments or borrowings.

This will give an indication of whether or not they have sufficient liquidity available throughout periods of economic uncertainty, potentially providing greater assurance for potential shareholders.

Furthermore, by taking all these factors into account investors can build up an accurate picture of Apple's current financial standing as well as its prospects for future growth and profitability.

READ ALSO: Apple's Organizational Structure and Management Style

Return On Equity Analysis

Apple Inc.'s return on equity (ROE) is an important measure to assess the company's financial performance as it provides a detailed analysis of how efficiently and effectively management utilizes shareholder capital.

Over the past five years, Apple's ROE has remained consistent at approximately 30%. This suggests that overall, Apple has performed well in terms of generating returns for its shareholders:

- Apple maintained favorable levels of profitability compared to other S&P 500 companies;

- The company employed leverage judiciously by maintaining low debt-to-equity ratios;

- The capital structure was managed wisely with conservative dividend payouts and periodic stock repurchases.

Overall, Apple Inc.'s ROE trends suggest success in creating value through the effective utilization of its capital structure. Moving forward, this strategy should be continued with attention paid towards near-term liquidity needs while preserving long-term growth potential.

With this in mind, we now turn our focus to analyzing Apple's dividend payout policy and how investors benefit from these distributions.

Dividend Payouts Analysis

Apple Inc. has consistently provided dividend yields to its shareholders over the past five years, which have been steadily increasing over time.

The company's dividend payout ratio has historically been in the range of 30-40%, implying a healthy balance between retained earnings and dividend payouts.

Apple's current dividend yield is estimated to be 1.7%, which is significantly lower than its sector peers.

This indicates that Apple is more focused on investing in research and development and retaining earnings for future growth.

Dividend Yields

The dividend yield is a financial metric that measures the return on investment for shareholders of Apple Inc. The dividend yield is calculated by dividing its annual dividend per share (DPS) by its current stock price and expressed as a percentage.

This provides investors an indication of how much cash flow they are receiving from their investments in comparison to the value of stocks held.

Over time, dividends have been one of the major drivers of returns for Apple Inc. shareholders based on growing dps over the years and increasing liquidity due to consistent positive cash flows generated by the company's operations.

With regards to liquidity, Apple Inc.'s strong balance sheet has enabled it to maintain high levels of capital adequacy which helps support its long-term growth prospects as well as providing security for its dividend investments.

In summary, Apple Inc.'s focus on increasing shareholder returns through rising dividend payouts combined with high levels of liquidity makes it an attractive option for investors seeking regular income streams from their portfolios.

Dividend Payout Ratios

Dividend payout ratios are another important metric used to measure the return on investment for shareholders of Apple Inc.

It is calculated by dividing total dividend payments for a given period with earnings generated over that same period and expressed as a percentage.

Dividend payouts have been rising steadily in recent years, supported by consistent positive cash flows from the company's operations which has enabled it to maintain high levels of capital adequacy and ensure long-term growth prospects.

In addition, the increasing dividend yields and strong balance sheet suggest further potential upside when it comes to dividends paid out to investors.

Overall, dividend payout ratios provide useful insights into Apple Inc.'s ability to generate returns through its investments while providing security for shareholder income streams.

Historical Stock Price Movements

Apple Inc. shares have experienced a high degree of market volatility over the past several years, often fluctuating by as much as 10% on any given day.

On average, Apple's stock has been up year-over-year since 2012, with significant yearly gains beginning in 2014 and peaking in 2018. The following table captures this pattern:

| Year | Share Price ($) | % Change from Previous Year |

|---|---|---|

| 2012 | 563.08 | -9.98% |

| 2013 | 543.90 | -3.55% |

| 2014 | 119.25 | +118.81% |

| 2015 | 105.67 | -11.48% |

| 2016 | 113.71+7.94%% |

The increased share price coincided with an aggressive repurchase program implemented by the company to reduce their number of outstanding shares on the public markets, known as share buybacks; these buybacks began increasing significantly in 2013 and peaked at $74 billion USD in 2018 before declining slightly in 2019 to $68 billion USD due to economic uncertainty resulting from COVID-19 pandemic events worldwide.

As a result of these trends, Apple was able to generate substantial returns for investors while limiting its exposure to market volatility affecting other firms during times of economic downturns or global crises such as what we are currently experiencing now.

With the understanding that the correlation between factors such as market volatility and share value is complex, it is important for analysts to continue studying how potential macroeconomic shocks may affect different companies differently depending on their respective strategies and industry positions.

Correlation Between Factors And Share Value

Apple Inc.'s stock price has experienced significant fluctuations in recent years, resulting from a variety of factors including market sentiment and industry trends.

An analysis of historical performance provides insight into the potential impact these factors have on Apple's share value.

Market sentiment is an important factor influencing investor confidence and thus the fluctuation of Apple shares. Increases in consumer demand for products such as iPhones or AirPods can affect investor expectations and drive up stock prices while concerns over product safety issues or delays in new product releases may cause investors to reduce their holdings and depress prices.

In addition, global economic conditions play a role in determining investment decisions related to Apple shares.

The technology sector also plays an essential role in dictating the future trajectory of Apple Inc.'s stock price, with changes in the competitive landscape having both positive and negative implications for share value.

Factors ranging from the increased competition through mergers & acquisitions to advancements made by competitors within specific markets can all influence shareholder sentiment toward holding Apple stocks.

As such, monitoring developments throughout the tech industry remains key when evaluating how changes will shape long-term returns for shareholders.

READ ALSO: Apple's Organizational Structure and Management Style

Frequently Asked Questions About Apple Financial Performance and Stock Market Trends

What Impact Has The Covid-19 Pandemic Had On Apple's Financial Performance?

The impact of the COVID-19 pandemic on Apple Inc.'s financial performance has been significant.

The disruption to the global supply chain, which was necessary for Apple's production, had a major effect as stores closed and demand shifted away from traditional sources.

Apple responded swiftly, streamlining its operations and improving efficiency in order to minimize losses.

Additionally, the company launched new services such as online classes that have helped offset some of the revenue lost due to reduced demand during the pandemic.

Despite these initiatives, overall revenue still declined significantly compared to pre-pandemic levels.

How Much Cash Does Apple Have On Its Balance Sheet?

Apple Inc. has a mountain of cash at its disposal, with the most recent balance sheet revealing an impressive $193 billion in cash and equivalents as of June 2020.

This formidable liquidity provides Apple with ample financial flexibility to pursue stock buybacks or other capital investments depending on market conditions.

With such a strong position in terms of cash flow, Apple is well-positioned to weather any economic storms that may lie ahead while also taking advantage of potential opportunities for growth.

What Is Apple's Dividend Policy?

Apple Inc. is known for its generous dividend policy, regularly returning a portion of profits to shareholders through the payment of dividends.

The company's current dividend yield stands at 1.44%, with an annualized payout rate of $3.08 per share.

Over the last five years, Apple has steadily increased its quarterly dividend payments by 7% annually on average, resulting in consistent dividend growth and providing shareholders with attractive returns over time.

What Are The Latest Developments In Apple's Research And Development Activities?

Apple Inc. has recently made strides in its research and development activities, with a focus on product launches and hardware upgrades that have been widely lauded by industry experts.

These developments are expected to further bolster the company's financial performance as well as its stock market trends over time.

The firm continues to invest heavily in research, launching new products such as Apple TV+ and AirPods Pro while also working diligently to upgrade existing products like the Macbook Pro and iPhone 11 series.

With these advancements continuing to shape the technological landscape of modern times, investors can anticipate seeing positive returns from their investments in Apple for years to come.

What Is The Outlook For Apple's Stock Price In The Near Future?

When it comes to the near future outlook for Apple Inc.'s stock price, long-term investing is key.

Currently, analysts predict that Apple's share prices will remain relatively consistent, indicating a secure financial position for the company in the coming months.

Further, with Apple having recently increased its dividend payments and instituted other shareholder returns initiatives, investors should expect continued stability from their investments over time.

Conclusion

Apple Inc. has been seen as a resilient company during the pandemic, with its balance sheet bolstered by impressive cash reserves and further investments in research and development activities to foster innovation.

Despite some volatility in their stock price due to uncertainty surrounding the global economy, Apple's long-term prospects remain strong.

With up-to-date knowledge of market trends and careful management of resources, investors can expect Apple to be like a phoenix rising from the ashes – emerging stronger than before, despite any current economic woes.

Thank you for reading our article today! Please remember to share this article on social media to help others benefit too. It also helps us improve our algorithm and relevance to the public. Thanks for Sharring!!! Follow us on Socials: Facebook - LinkedIn - Twitter